The Resurgence of Dollar Dominance: The Battlefield at 100 and Ambition for 110

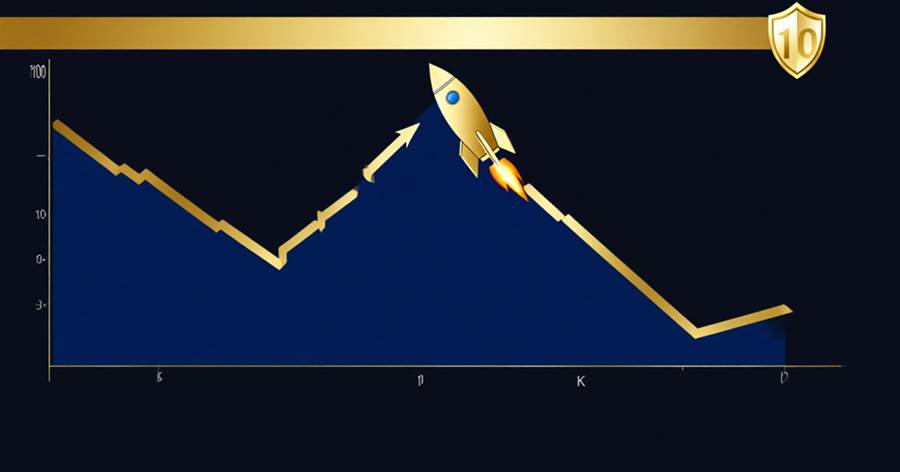

When the dollar index breached the 99.8 resistance level and charged toward the psychological 100 threshold, global forex markets held their breath. On July 31, this critical gauge climbed to a one-month high—a seemingly sudden dollar offensive that was, in truth, the culmination of meticulously orchestrated forces.

The 48 hours following the Fed’s rate decision became the dollar’s launchpad. Though the federal funds rate remained anchored at 4.

25%-4.50%, Chair Powell’s press conference harbored a hawkish signal: "No decisions have been made regarding September rates." This ostensibly neutral remark became rocket fuel for the dollar as markets craved rate cuts but found only Fed hesitation.

Dollar bulls dreamed bigger. Goldman Sachs detonated a bombshell forecast: The DXY could shatter 110. This prediction rests on a "strong-dollar cycle" thesis—global growth divergence, geopolitical risk premiums, and potential Fed policy lag collectively cementing the greenback’s foundation.

Should this materialize, the index would hit 20-year highs, echoing 2022’s dominance.

Yet the dollar fortress isn’t impregnable. Standard Chartered analysts sounded the alarm: The Fed itself poses the "primary threat" to dollar bulls. This paradox stems from policy logic—the central bank’s independence allows dovish pivots if data deteriorates, while Trump-era protectionism lingers. When political pressure collides with economic reality, Fed policy shifts could become the Achilles’ heel of dollar hegemony.

The dollar’s strength runs deep. Interest rate parity theory shows U.S. real rates dwarfing major developed economies, sucking in capital flows. Its safe-haven status shines as global tensions escalate. Crucially, despite de-dollarization noise, the greenback still claims over 58% of global reserves—a testament to its unshakable network effect.

History rhymes ominously. The DXY’s 2022 peak at 114 saw Fed hawkishness, the Ukraine war, and Europe’s energy crisis converge.

The article is not finished. Click on the next page to continue.

The article is not finished. Click on the next page to continue.